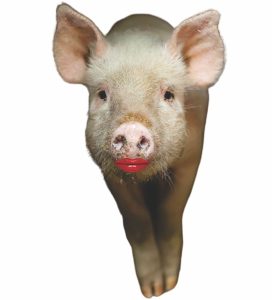

Are you slapping lipstick on a pig?

There are many reasons people decide to sell their current home. For many, however, it is not a happy reason. People are under stress, lost a job, financially strapped, dealing with death, divorce and or separation. We agree these are definitely not the best of times to add more stress and anxiety to the mix. We find some people will say they are scared of the market (hot, cold, slow, indifferent) scared of making a bad/wrong decision and some are just plain scared – paralysis analysis with so much information on the internet it is a wonder decisions can be made without worry.

One way to ease the stress and anxiety is to fully prepare the house for sale. Not in a slapdash, haphazard way, but fully vested in the process of making the house “move in ready”. I can already hear you saying “oh but we don’t have the money” …. truly the world is full of money we just need to find some for you. (More on that later). So many people, agents, and sellers throw “costs too much & don’t have time” up as reasons to not fully prepare a house for sale. I declare, without exception, they are filtering costs as a loss of money, instead of seeing it as an investment which will make money (I know you don’t have money).

Consider this:

For the average person a house represents at least 60% of their financial portfolio. They may not think of it like that, but a portfolio is simply a collection of assets (cash, savings, retirement funds, pensions, stocks). Risk averse investment strategies, with hidden values are best to maximize portfolio gains as well as safety. (sic TSI Wealth Daily) Most people avoid risk.

Risk Aversion:

InsideBE.com describes this as “the preference people have when they choose an outcome that’s certain, over one that’s uncertain. Most people dislike ambiguity, so when faced with a tough decision, they’ll generally go for the “safer,” risk-free option. The “price tag” of risk aversion can be anything you’re willing to sacrifice in order to avoid uncertainty. There is no denying risk aversion is present in everyone and has a profound influence on decision making. Risk-aversion people are less likely to participate in unhealthy behaviours, look both ways before crossing a street and wouldn’t dream of wagering their house in a bet, which are all good things to keep us safe. At the same time risk-aversion is associated with poorer decision making when faced with complex important decisions. Think of all the innovations and businesses which exist as a result of someone taking a risk. Uncertainty is a situation when a client doesn’t have all the information, or concerns have not been addressed. One of the behavioural economics famous experiments is the Allais Paradox: a choice between two gambles which clearly shows human irrationality in the face of uncertainty.

Faced with two choices:

Option A: a 100% chance of winning $100million, OR

Option B: a 10% chance to win $500 million,

89% chance of winning $100 million and a 1% chance of not winning anything. Most people chose Option A over B. From a financial perspective, the 99% chance of winning either $100 million or $500 million is well worth the 1% risk of going home empty-handed, and the expected value of Option B trumps Option A. However, this is where risk aversion comes into play. Despite not being the best choice, the certainty of Option A is more attractive than the uncertainty of Option B. People are even willing to “pay” the extra $100 million as a risk premium to attain this certainty.”

What does this have to do with selling a house?

What does this have to do with selling a house?

Well, which would you choose?

Option A: Fully prepare the property for sale.

RISK: Takes time and money brings HIGH ROI

Option B: Lipstick on a pig approach

RISK: quick easy but leaves money on the table

Option C: List “as is”

RISK: Offers which are less than you expect from savvy investor/flippers who want to make it move in ready and stash the high cash return

Sadly today, many sellers and agents are opting for Option B; however, if you want your

property to stand out from the crowd Choose Option A! It is significantly the best choice if you

want to build that financial portfolio of yours.

TIPS: If you are thinking of selling a house:

- Start early. Don’t wait until you are desperate, stressed and at a point where you cannot help but jeopardize your investment return.

- Be willing to invest the time and money to get the best return- all in. (I know the money thing hasn’t been answered-yet)

- Start by hiring a Certified Staging Professional® for an unbiased objective review of your property.

- Staging consultations range from ridiculously low to around $1,000 depending on the size of your house.

Let’s settle on $500 as a mid-point. Anyone can call themselves a stager, only an elite group qualify as Certified Staging Professionals®. Trust me you do not want “free” or “cheap” “down and dirty” or “lipstick on a pig” when dealing with your largest investment.

HINT: If you start giving reasons to not change things you are for sure too emotionally connected to the

property to be objective.

If you would wash and prepare a car for sale then it’s the same thing for a house except the return is higher…. the more move in ready it is the easier it is to sell for more than others which are not prepared for the buyer.

Park your personal feelings. The recommendations are made with the buyer in mind- what they want. Research shows 69% of buyers of resale properties really want a new build. The upgrades which matter most to buyers will factor into the recommendations the CSP® provides.

THE MONEY question answered.

Not to be facetious, but the world truly is filled with money before some is sourced for you – you will need a check up from the neck up to decide if you are ready to take a risk? I am not talking lottery ticket risk (although the results will feel like you won the lottery).

The investment to get your house move in ready is less than a price reduction in a slow or uncertain market and in a hot market ensures you don’t leave money on the table. Can I guarantee your house will sell for hundreds of thousands more than asking? Of course, I can’t do that, – no crystal ball. The buyer decides the value of a house. What I can guarantee is your property will stand out from others, have the best photos on the MLS and you will optimize your opportunity to secure a buyer. The money? Ok can you borrow it from a family, secure a line of credit? Sell something? OR working with a trusted staging advisor you can access one of the many services whose business is bridging the gap for the money needed to bring your property to tip top condition, paid back after the sale from the equity secured. Think about that – there are many companies now, in the business of loaning the money specifically to improve the look of real estate before it goes onto the market- RISK takers who have realized a gap in the market and are filling it!

They see it as a no risk situation– do you?

There is no better time than right now to take the plunge if you are interested in starting a home staging business. Contact me, Christine Rae today to learn more! Or request our information booklet to become a home stager and start your real estate staging business with staging certification from CSP International™!

There is no better time than right now to take the plunge if you are interested in starting a home staging business. Contact me, Christine Rae today to learn more! Or request our information booklet to become a home stager and start your real estate staging business with staging certification from CSP International™!

Subscribe Today!

Subscribe Today!